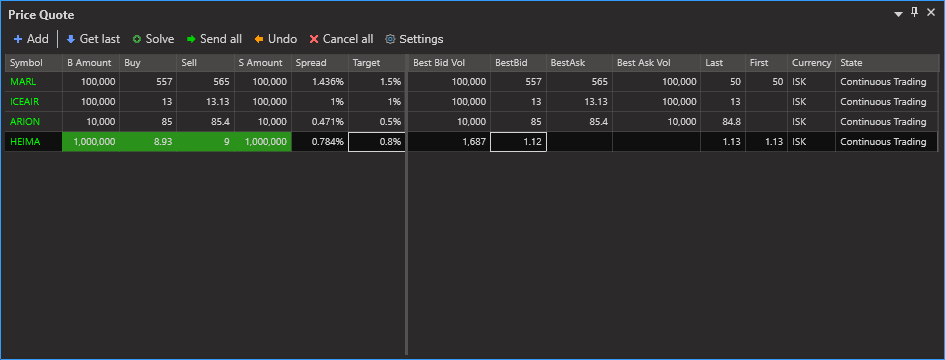

Price Quote

In the price quote window it is possible to create a list of instruments and manage multiple orders for those instruments.

Image: Price Quote Window

New MiFID II Order Entry Fields

The new MiFID II Order Entry Fields are sent with the market orders through the Price Quote control, the values that are sent are the default values that can be configured in Settings → MiFID tab. Further instructions can be found /wiki/spaces/OMS3/pages/319750410.

Users can

Add and remove instruments from the price quote list

Manage default properties and values for the instruments

Choose different spread for each instrument. The price quote window also calculates the spread for the orders

Solve Spreads: The user can let the system calculate the sell price so that it spread matches the default spread.

Send all changes to orders to the market at the same time.

Cancel all changes. Users can cancel the changes that they have made to each order.

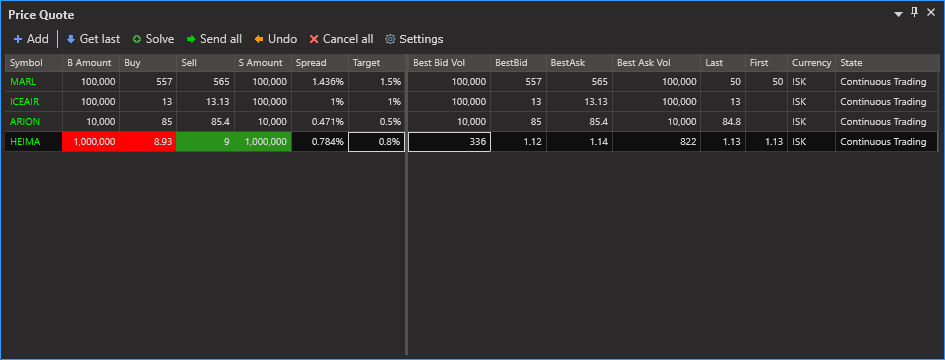

Fat fingers warning

Price Quote Window warns the users has typed in price that is far from the market (will be executed directly if he send the order to the market) .

User gets a warning if:

- Sell Price is lower than the best market Buy Price

- Buy Price is higher than the best market Sell Price

Image: Here has the market maker typed in a buy price that is higher then the best Sell price on the market.

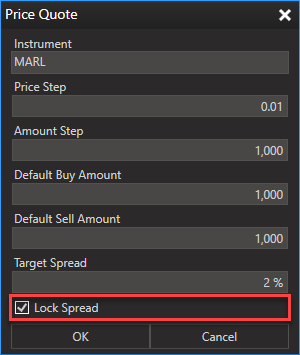

Lock Spread

It is possible to lock the spread calculation. When a user changes the Buy/Sell price the system automatically calculates the Sell/Buy price according to the target spread. This feature is enabled in the Settings for each instrument in the Price Quote window.

Image: Price Quote Instrument settings where the market maker can Lock The Spread.