Allocation is the operation of sending executed trades to the back office.

The Allocation specifies how trades should be split among different customers and portfolios.

The process of allocating has been improved. In the current version of Kodiak OMS you are only able to allocate Client Orders.

You can now allocate Client Orders, Market Orders and individual Trades.

Business Rules

Any trade can be allocated.

Allocation fields:

- Information about the client order

- List of allocation „elements" which contain

- Customer

- Portfolio

- Quantity

- Fee type

- Fee

- Other fee amount

- Email and a preliminary note.

Traceability

Client Orders can have many market orders and pre allocations. Market orders can have many executions.

When the OMS creates an allocation for a client order it will store a reference to the executions behind a single client order.

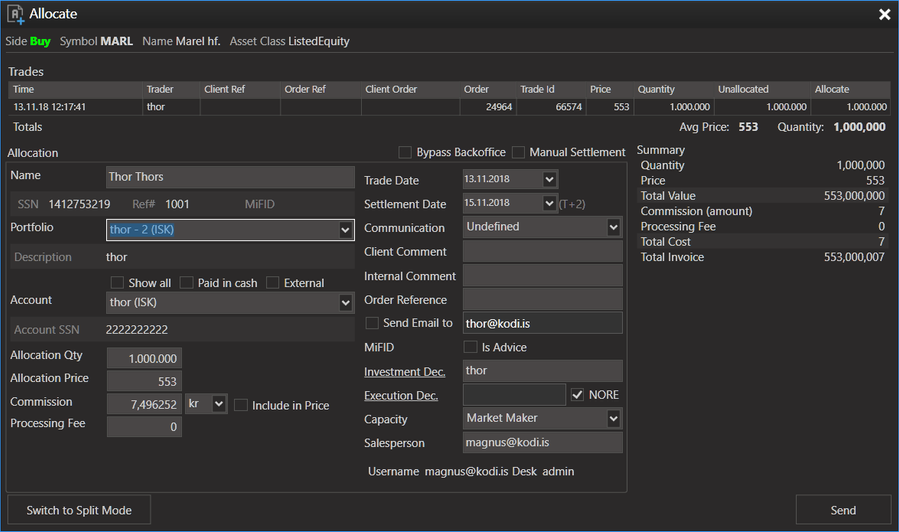

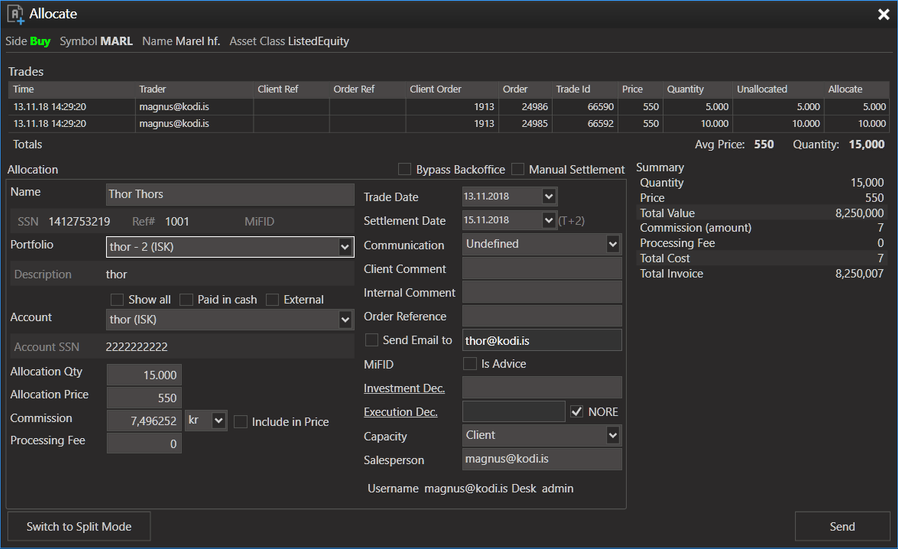

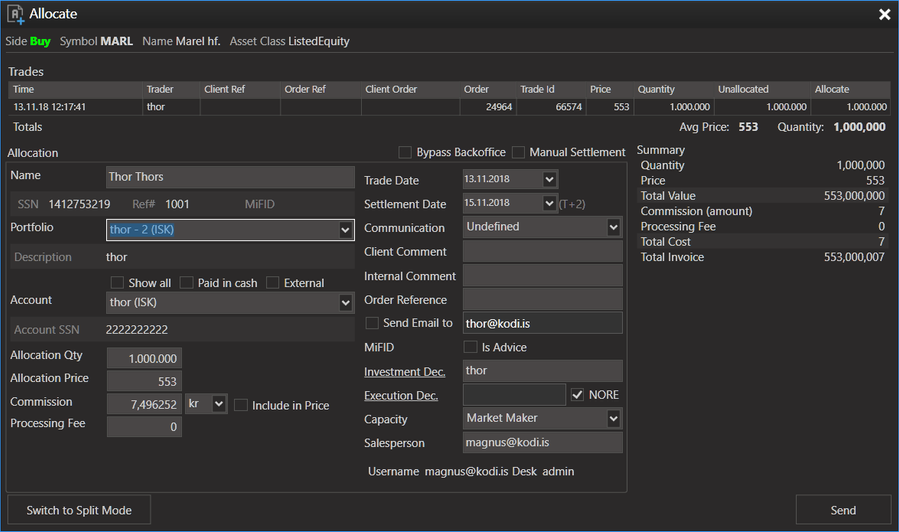

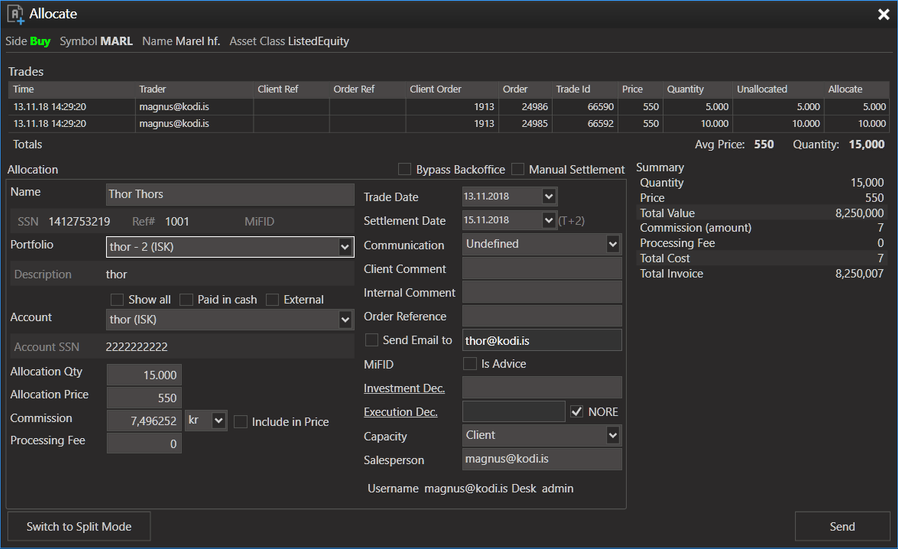

The Allocation Entry window:

You can now select the customer and portfolio by entering the external reference number of the portfolio in the portfolio drop down.

You can now allocate Client Orders, Market Orders or individual Trades.

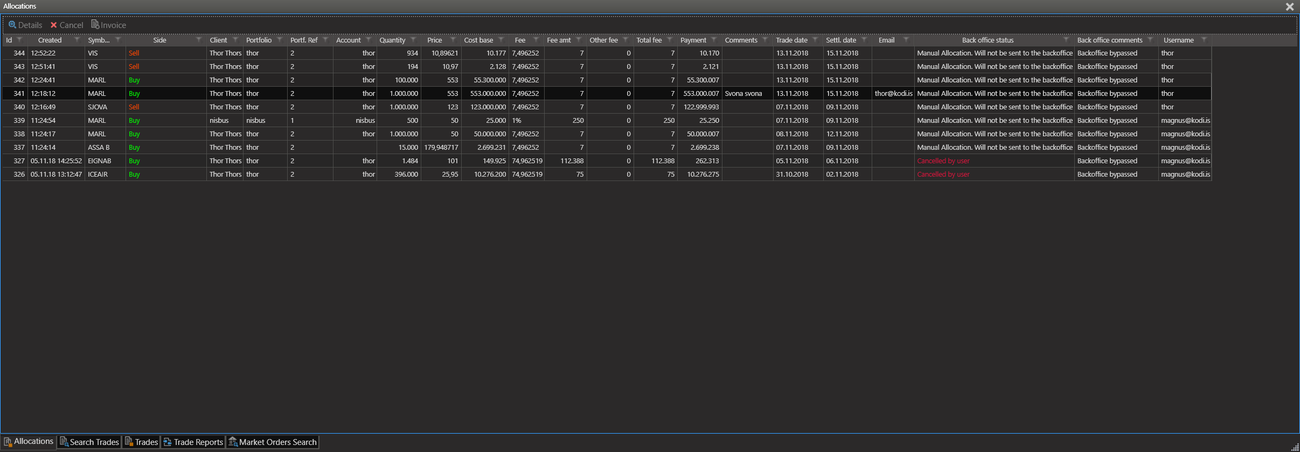

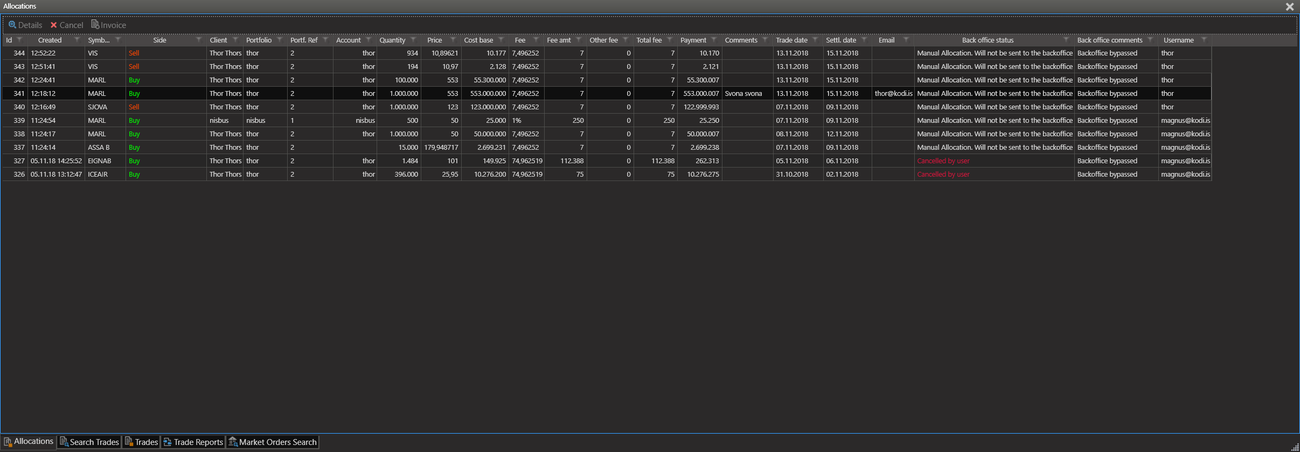

The Allocations View control will display a list of current Allocations.

Allocation Information

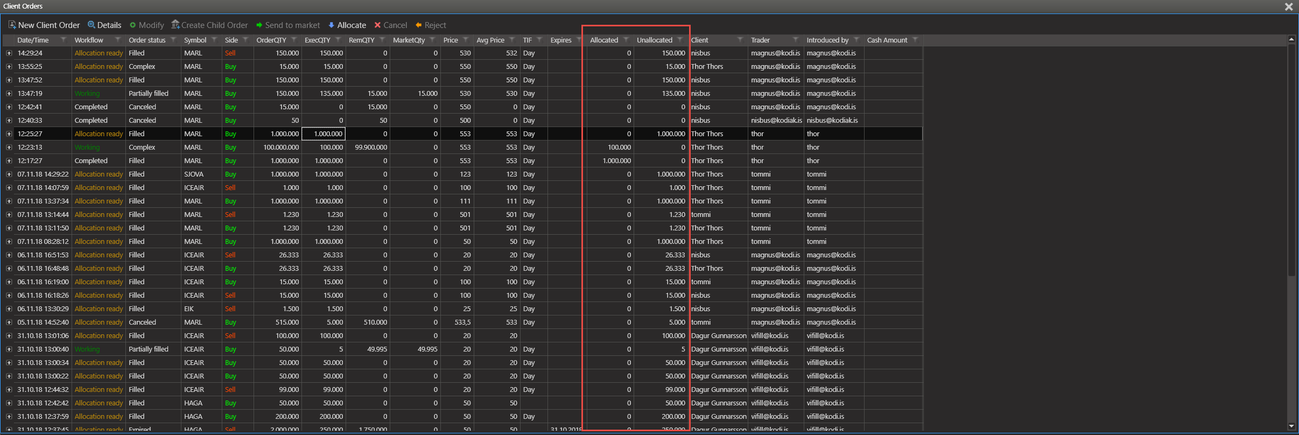

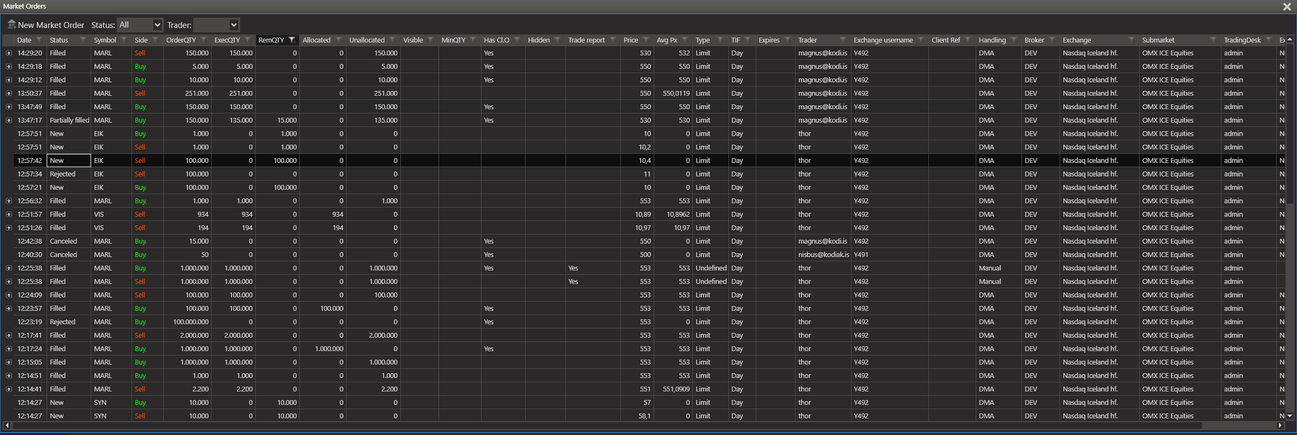

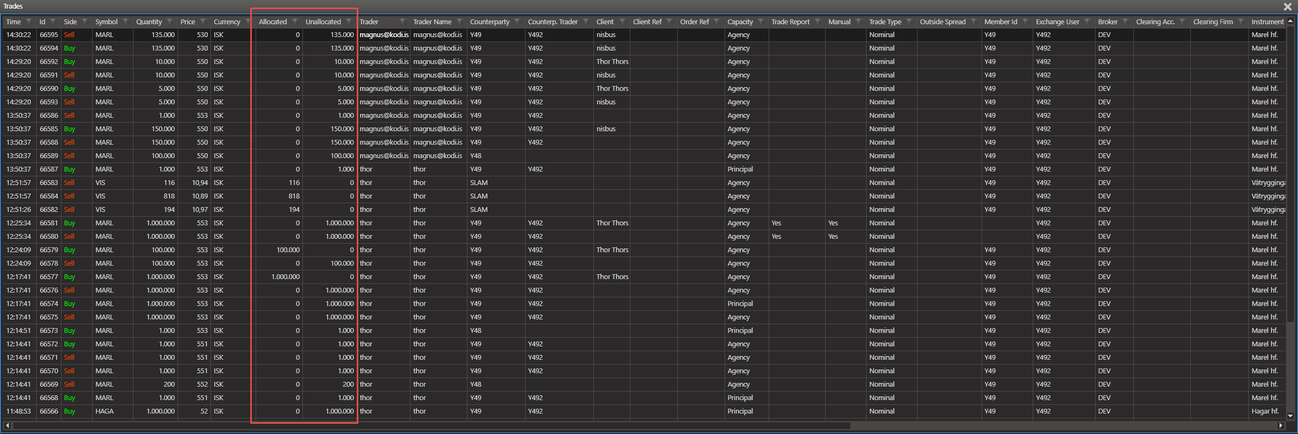

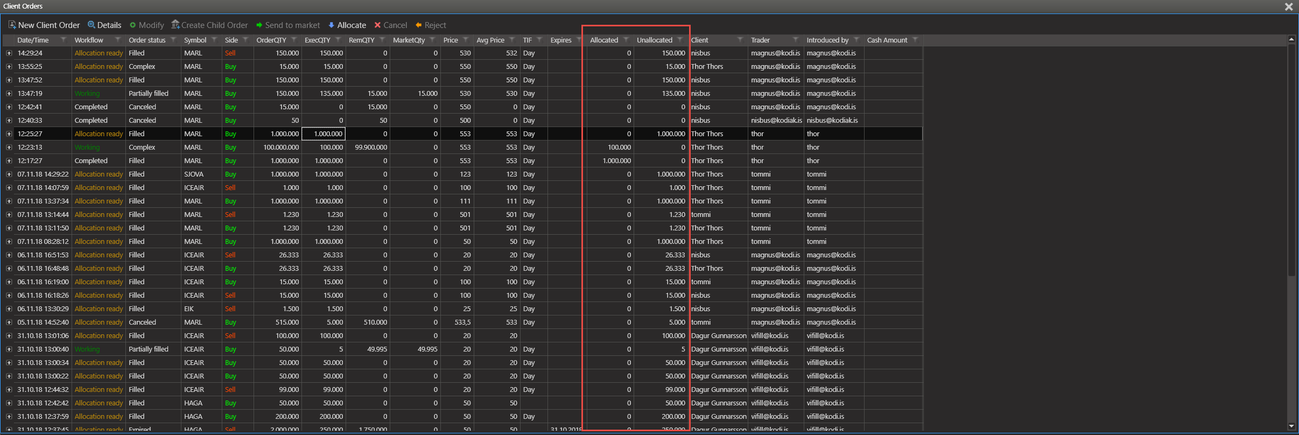

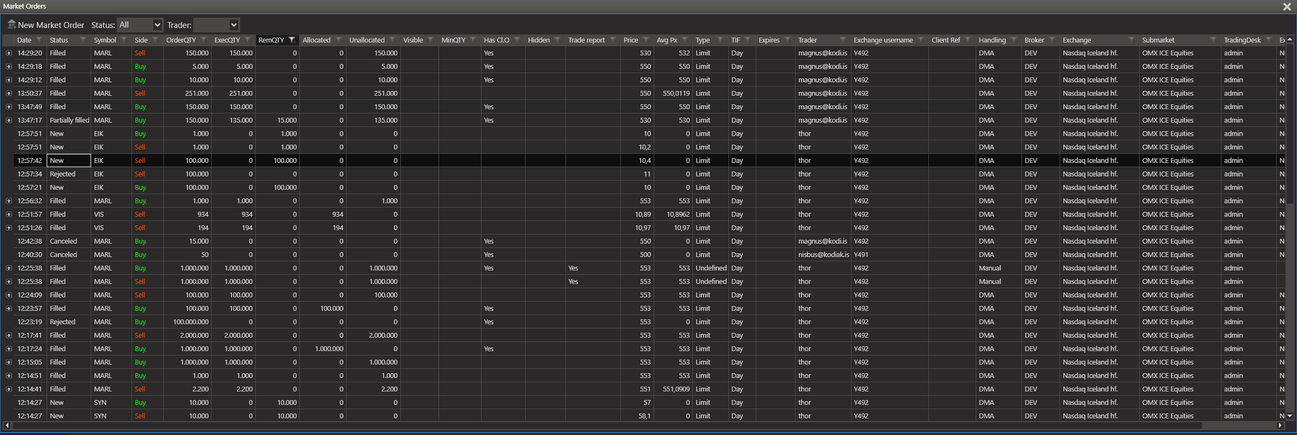

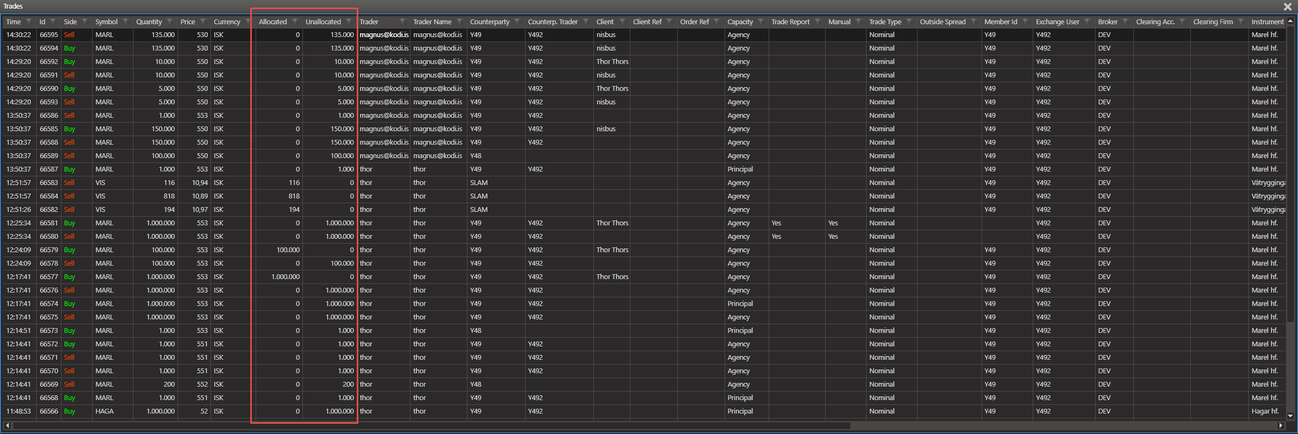

You can see Allocation information on Client Orders, Market Orders and Trades.

The Allocated and Unallocated quantity will be shown.

Client Orders

Market Orders

Trades