/

Create Market Order

Create Market Order

Description

The Market Order Entry Window allows you to create a DMA order and send them to a broker on the market.

The Market Order Entry Window allows you to create a DMA order and send them to a broker on the market.

How to access

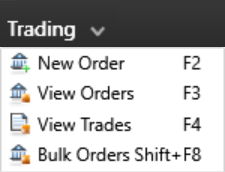

You can open the Market Order Entry Window by clicking 'Ctrl N' or by selecting the New Order action in the Trading menu.

You can open the Market Order Entry Window by clicking 'Ctrl N' or by selecting the New Order action in the Trading menu.

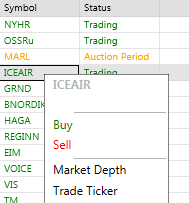

It is also possible to select a symbol in the watch list and create a order from there.

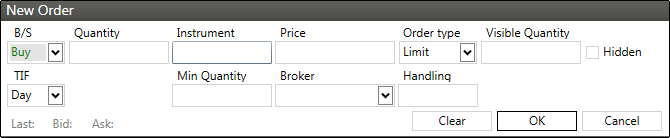

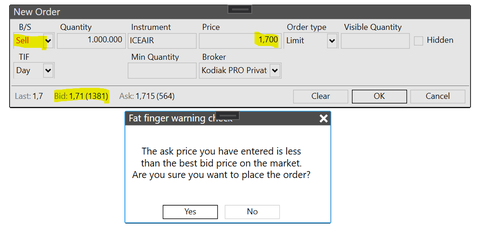

New Order window

Fields in the Market Order Entry Window

Field | Description | Notes |

|---|---|---|

| B/S | Buy or Sell order | |

| Quantity | The Quantity being bought or sold | |

| Instrument | The symbol/company | Autocomplete text box. Type in the first letters and the system will suggest from available instruments. |

| Price | Price - used to specify a limit price for the order. For pegged orders, the price field can be used to specify a Cap Price. | |

| Order Type | Order Type | Limit, Market, LOO, LOC, MOP, MOC, IOOC, IOOP |

| Visible Quantity | Usually called iceberg order. The quantity that will be displayed on the market. | |

| Hidden | Makes the order hidden. This only works for orders with large quantity. | |

| TIF | Time In Force | Day: Valid until the end of the trading day. |

| Date | Used when GTT is selected in the TIF | |

| Broker | The broker that the order will be sent to | |

| Handling | How the broker will handle the order. | DMA, Manual. |

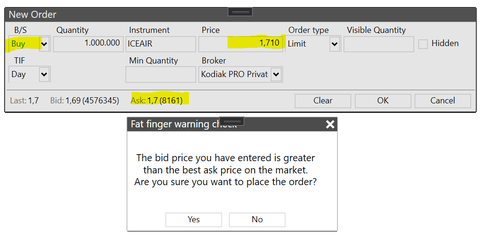

Fat finger warning

The Fat finger warning is turned on by default. It can be turned off in Tools → Settings.

When this setting is turned on, the Kodiak client warns the user if they are entering an order that will be executed immediately.

The fat fingers warning will appear when:

- The bid price you have entered is greater than the best ask price on the market.

- The ask price you have entered is less than the best bid price on the market.

Fat finger warning when the bid price the user has entered is greater than the best ask price on the market.

Fat finger warning when the ask price the user has entered is less than the best bid price on the market.

, multiple selections available,

Related content

Create Market Order

Create Market Order

More like this

Market Orders

Market Orders

More like this

Market Order Types and Attributes

Market Order Types and Attributes

Read with this

Market Order Entry Window

Market Order Entry Window

More like this

Orders Management - Trading

Orders Management - Trading

More like this

Orders Management - Trading

Orders Management - Trading

More like this