KODIAK Derivatives Home

KODIAK Derivatives Home

KODIAK Derivatives

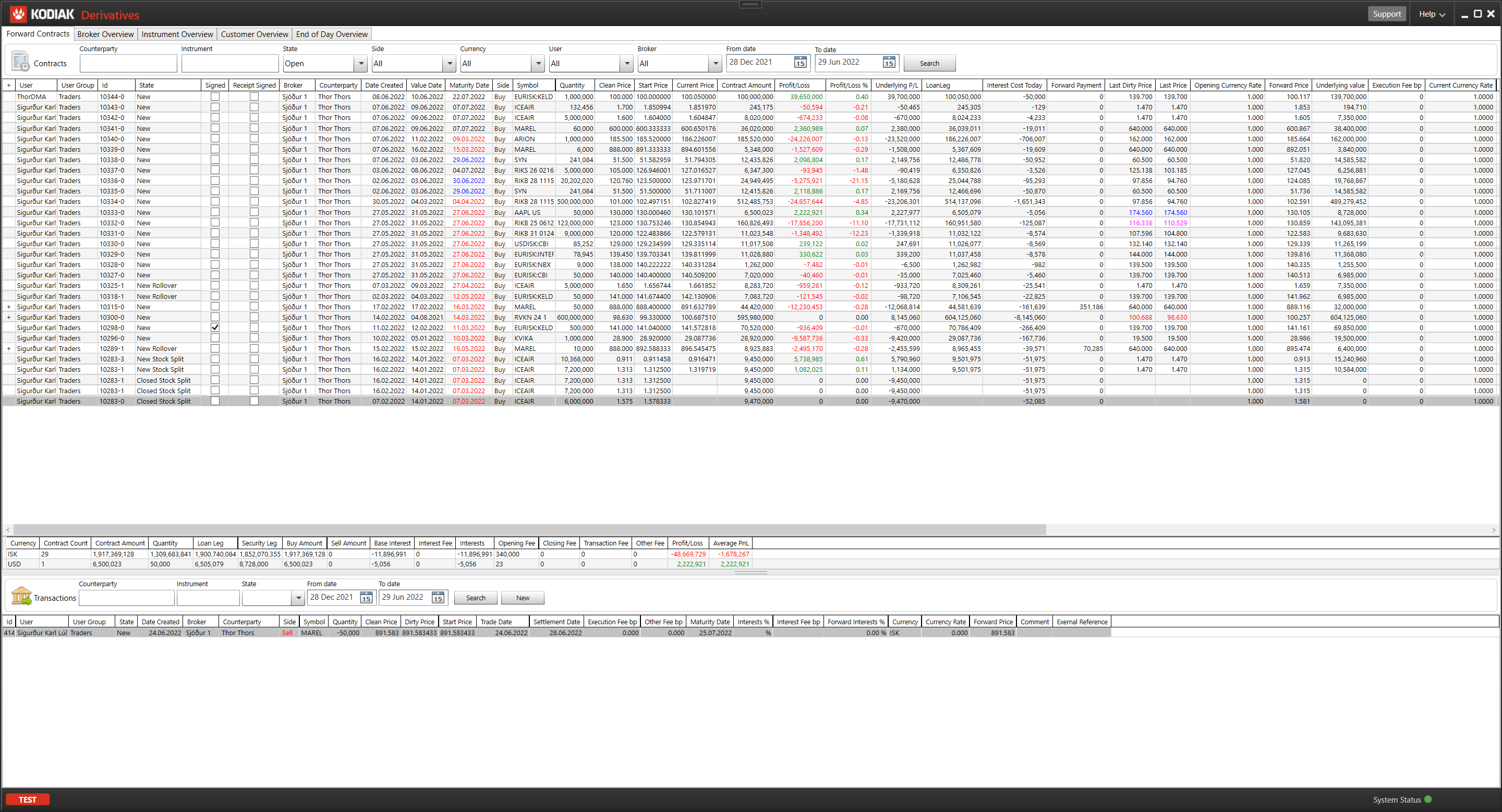

KODIAK Derivatives is a front office system for managing equity, bond and foreign exchange Forward Contracts. It keeps you informed of your profit or loss of your whole portfolio or narrowed down to individual customer or instrument at any given time based on actual market data. KODIAK Derivatives is particularly designed for Icelandic securities and to meet Icelandic investment banks needs in that respect. It can stand on its own or work in combination with KODIAK Oms trading software where actual trades with securities can be marked as Forward Contracts and show up automatically in KODIAK Derivatives. This workflow will create a perfectly hedged derivatives portfolio as well as minimize all input errors. Kodiak Derivatives includes information about Icelandic bonds, interest payments and equity dividends payments that automatically get accounted for in all Forward Contracts.

- Features

- Create long (buy) and short (sell) forward contracts

- Terminate/Close contracts

- Partly close a contract

- Rollover single contracts

- Rollover multiple contracts

- Netting multiple contracts

- Monitor open contracts with real time P/L

- Search for contracts based on customer or instruments

- Dividend and bond payments management

- Print out contracts documents (new contract/closing receipt/term changes)

- Sign contracts or receipts

This is a user manual for Kodiak Derivatives. This manual describes the main features of the systems and how to use them.