Rollover a Contract

Overview

Rolling over a contract gives you the option to change the maturity and withdrawal/deposit cash from the contract. It creates a new contract with the same attributes depending on how much is withdrawal/deposit from the contract. Rolling over a contract can be done from the trade date until it matures. Rollover can also be done for multiple contracts at once, see Multiple Rollover.

Get Started

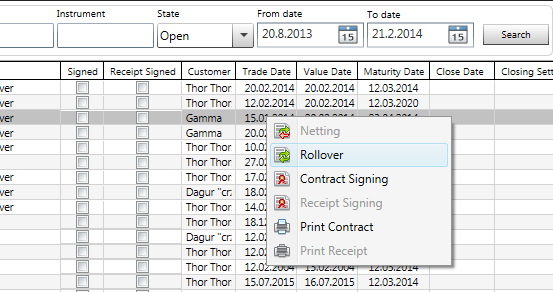

From the Contracts grid click on the contract to rollover.

Rollover window

When the window opens you get the option to change the Maturity Date, set Fees, change the Interest Rate and if there is a profit on the contract you can withdrawal cash out of the contract and deposit cash into the contract if there is a loss on the contract.. Changing the Maturity Date and the Interest Rate will effect the Forward Price for the new contract.

Definitions

| Customer Details | |

|---|---|

| Field | Definition |

| Customer | The name of the customer of the contract |

| Selected Contract | |

|---|---|

| Field | Definition |

| Contract ID | The ID number of the contract to close |

| Symbol | The symbol of the underlying instrument |

| Quantity | Number of shares of the underlying asset |

| Value Date | The start date of the contract |

| Maturity Date | The date the contract will expire. |

| Contract Amount | The Start Price * Quantity |

| Start Price | This is the opening price of the selected contract |

| Current Price | This is the Start Price + accrued interest until today |

| Interest (%) | The interest % is the interest amount of the contract. |

| Interest Fee (bp) | Interest fee that is added to the contract. |

| Forward Interest (%) | Forwards interest. Interest + Interest fee. |

| Payments | If the underlying asset bears interest/dividend payments during the lifespan of the forward contract. This is what gets added/subtracted |

| Forward Price | The Start Price + accrued interest until the maturity of the selected contract |

| Current Profit/Loss | The contract profit or loss from the customers side. (Last Price (on the market) - Start Price) * Quantity |

| Withdrawal/Deposit | The amount the customer wants to take out of the contract or put in if there is a loss |

| Calculate Tax | If there is a profit on the contract and the customer whats to withdrawal money from the contract. This is the option to calculate tax from that amount |

| Tax | 20% of the P/L amount |

| Closing Profit/Loss | The profit form the selected contract after withdrawal and tax. Or in the case where there is a loss on the contract this is the total loss after deposit if any |

New Contract | |

|---|---|

| Field | Definition |

| Contract ID | The ID number of the new contract |

| Symbol | The symbol of the underlying instrument |

| Quantity | Number of shares of the underlying asset |

| Value Date | The start date of the new contract |

| Maturity Date | The date the rolled over contract will expire. |

Final Interest Date | The next bank day or the settlement date after the contract expires. (T-1 for bonds and T-3 for equity) |

Rollover Fee | Fee charged to the customer for rolling over. Usually a default amount decided by the bank |

Transaction Fee | Is a default amount decided by the bank |

Closing Fee | Fee charged to the customer for closing the contract. Usually a default amount decided by the bank |

| New Contract Amount | The new Start Price * Quantity |

Collateral Margin (%) | The % of collateral margin if any |

| Start Price | This is the Start Price of the previous contract + Fees + accrued interest |

| Interest (%) | The interest % is the interest amount of the contract. |

| Interest Fee (bp) | Interest fee that is added to the contract. |

| Forward Interest (%) | Forwards interest. Interest + Interest fee. |

| Collateral Margin | The Collateral Margin the Customer has for this trade. This is only for informational purpose and does not alert any margin calls. |

New Forward Price | The Start Price on the new contract + accrued interests until maturity |

New Forward Amount | The New Forward Price * Quantity |