Partially Close Contract

Overview

Partially closing a forward contract is when the quantity of an open contract is reduced. This can be useful when a customer wants to change his position before the maturity of the forward contract or when the bank is not able to buy or sell the whole notional value of the underlying asset at once on the market to close out the forward contract. Partially closing a contract can either be done with a short or a long position and even after the forward contract has matured.

Get Started

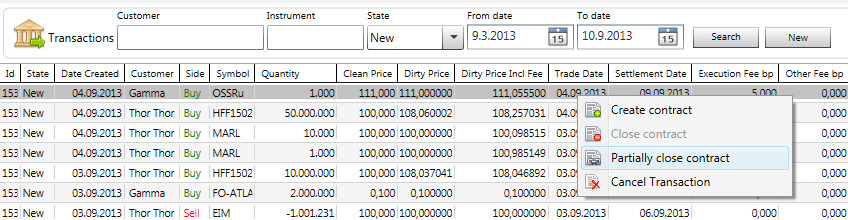

To partially close a forward contract a trade from the Transaction Grid has to be right clicked and the "Partially Close Contract" option selected. A trade on the market or a manual transaction has to have be made in order to partially close a contract. For a long position forward contract you need to sell the underlying asset for an notional amount that is less then the forward contracts underlying notional amount and vice versa for a short position forward contract.

The Partially Close Contract Window

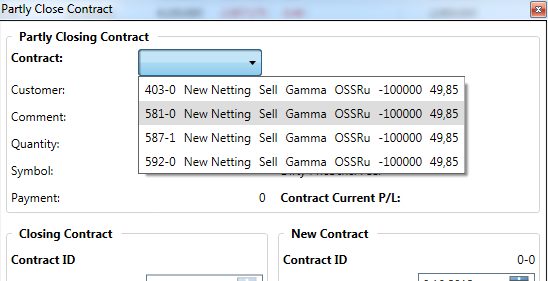

If there are multiple open contracts for the same customer, same underlying asset and same side (buy/sell) you will have to select which forward contract you wish to partially close.

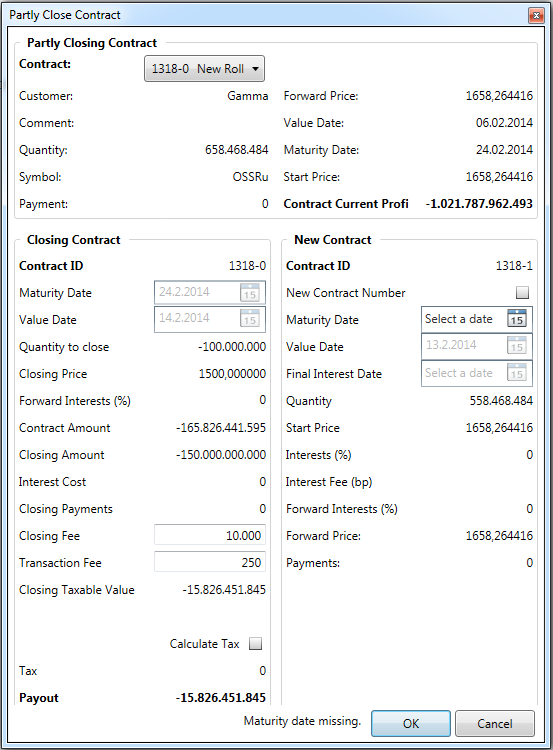

The window will give you the options to set a Closing Fee and a Transaction Fee for the contract to be closed and give you the option to change the Maturity date for the new contract

Fields in the Partly Close Contract Window

Field | Description |

Partly Closing Contract | The partly closing contract information grouped together |

Contract | A drop-down menu to select witch contract to partially close |

Customer | The name of the customer. |

Quantity | Number of shares |

Symbol | The symbol of the underlying instrument |

Payment | Payment on the bonds if any during the lifespan of the contract |

Forward Price | The forward price on the create date |

Value Date | The effective date / start date on the contract |

Maturity Date | The date the contract was to expire. |

Start Price | The start price from the previous contract + accrued interests |

Contract Current P/L | Profit or loss of the selected contract |

Closing Contract | The closing contract information grouped together |

Contract ID | The number of the contract to close |

Quantity to Close | The amount of quantity which is to be closed |

Closing Price | The Price the contract will be closed on. This is the Dirty price on the underlying trade that was made to close the contract |

Forward Interest (%) | Forward interest (%) = Interest Rate + Interest Fee |

Contract Amount | Start Price * Quantity to Close. |

Closing Amount | Closing Price * Quantity to Close |

Interest Cost | The amount of the interest the customer has to pay |

Closing payments | The closing payment if any |

Closing Fee | Is a default amount decided by the the bank |

Transaction Fee | Is a default amount decided by the the bank |

Closing Taxable Value | The value between the contracts amount and the closing amount |

Tax | Tax is 20% from closing taxable value |

Payout | If the underlying asset has had interest or dividend payments over the lifespan of the contract they will be added to the Start price for long contracts and subtracted for short contracts |

Contract ID | The ID number of the new contract |

Quantity | Number of shares |

Interest (%) | The Interest % of the new contract |

Interest Fee (bp) | Interest fee is added on the interest % |

Forward Interest (%) | Forward interest (%) |

Forward Price | The start price + forward interests |

OK/Cancel | Click OK if you want to partly close the Contract otherwise Cancel |