Overview

Netting multiple forward contracts is possible when you have multiple open contracts for the same customer and for the same underlying asset. The contracts can be on either side (buy/sell) and have various maturity dates. Netting will create a new forward contract that has a quantity (principle amount) that is equal to the sum of all the selected contracts to be netted and have the dirty price (spot price) that is the weighted average of the dirty prices of all the selected contracts to be netted.

Get Started

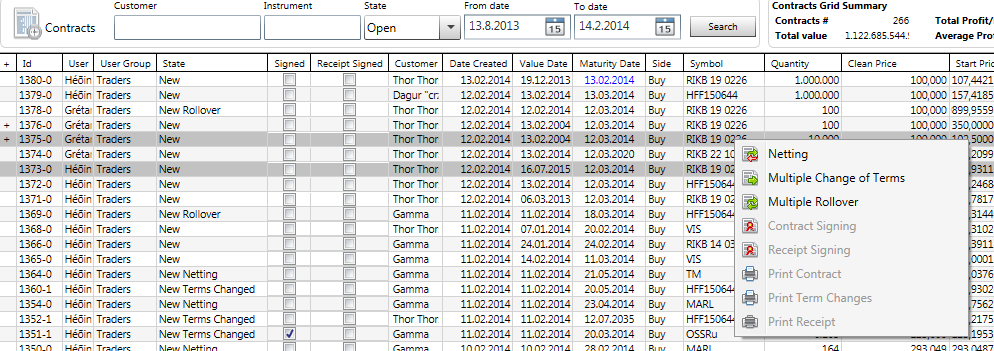

To net multiple contracts select all the contracts to be netted from the Contracts data grid in the main window. Multiple select can be done by holding down the Control button while selecting the contracts with the mouse. With multiple contracts selected right click one of the selected contract and choose Netting from the context menu.

The Netting Window

Start date, expiry date, interests and fees for the new contract are set in the netting window. The start date will determine when the new contract will become active and the forward price will be determined from the start date. Expiry date sets the maturity of the contract and final interest date will be determined on the expiry date, T-1 for bonds and T-3 for stocks. Netting Fee and Transaction Fee will effect the New Dirty Price (spot price) for the new contract, The default value for the New Interest Rate and New Interest Rate Fee will be the average interest rate of selected contracts to be netted.

Field | Description |

Symbol | The symbol of the underlying instrument. |

Quantity | Number of shares being bought or sold. |

Trade Date | The creation date of the trade. |

Settlement Date | The value date when the trade becomes active (T+1 for bonds or T+3 for equity) |

Clean Price | Clean price on the market. |

Dirty Price | Dirty price is clean price plus accrued interest on the settlement date. |

Execution + Other Fee bp | Execution fee is the fee that the broker charges for the trade. Other fee is typically a back office fee. |

Dirty Price Incl. Fee | Dirty Price Incl. Fee = Dirty Price + execution fee + other fee. |

Trade Amount | The transaction underlying traded value. Dirty price incl. fee * Quantity |

Forward Contract Details | Forward contract details grouped together. |

Creation date | The date when the contract is created. |

Expiry Date | The maturity date the contract will expire. |

Final Interest Date | The next bank day or the settlement date after the contract expires (T+1 for bonds or T+3 for equity). |

Opening Fee | Is a fee that the bank charges for creating the contract. |

Dirty Price Incl Fee | This is the spot price of the contract. It includes the Dirty price + execution fee + other fee + opening fee |