Forward Contracts mimic the cash-flow of the underlying instruments. Therefore KODIAK Derivatives needs to generate the correct cash-flows for all forward contracts. For contracts with underlying bonds, the system needs to generate and attach all interest payments to the correct forward contracts. For contracts with underlying shares, the system needs to generate and attach all dividend payments to the correct forward contracts.

Interest Payments

The Interest payment schedule for bonds is calculated by Kóði based on information published by the NOMXI Stock Exchange. Kóði also calculates the size of each payment (principal + interests + index adjustment). The KODIAK Derivatives system uses these calculations to attach those interest payments to each bond forward contract.

Dividend Payments

According to the Icelandic Security Depository: Ex-dividend date is the day on which all shares bought and sold no longer come attached with the right to be paid the most recently declared dividend.

Dividend payments are added to forward contracts in two steps.

- First they are entered into a Back Office Interface that saves them to a database table.

- After the dividend payments are inserted into the database, the same job that insert interest payments on bond contracts picks them up and adds them to all open contracts with that particular underlying share.

Back office interface

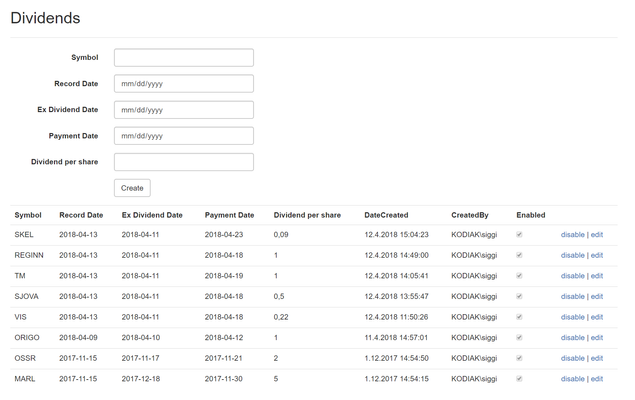

In the back office web interface, users can insert/edit and disabled dividend payments. Users have to provide

- Symbol: market symbol of the share

- Ex Dividend Date: the day on which all shares bought and sold no longer come attached with the right to be paid

- Record Date: the day when you must be on the company's books as a shareholder to receive the dividend.

- Payment Date: When is the dividend payment paid out (and starts bearing interests).

- Dividend per share: Monetary value paid out per share of stock

Payments Job

The payments job has two roles. Firstly to attach interest payments to contracts with underlying bonds and secondly to attach dividend payments to contracts with underlying shares.

Attaching dividend payments

The job goes through all enabled dividend payments that have Ex Dividend Date (CalcDate in the Database) less or equal today and attaches payments to all open forward contracts with the same underlying share and with SettlementDate less than the CalcDate.

Attaching interest payments

The job goes through all underlying bonds that have open forward contracts. For each interest payment that has occurred in the bond's cash flow it attaches a payment to each open forward contract (rightsDate <= ExpiryDate && !x.IsClosed && SettlementDate < rightsDate)) where rightsDate is the previous bank day of the interest date of the interest payment.

Payments in rollover or partially closing

When payments are applied to contract, situations can arise where the payment needs to be transferred from contract that is being rolled over or partially closed to the new contract being formed as a result of those actions.

The reason is as follows. When a payment is due, whether interests payment or dividend, the price of the underlying security will reflect that payment on the ex-dividend day. To prevent the price of the contract to drop when the underlying price changes, each open contract will receive a payment where due on ex-date of said payment.

If contract is closed before the payment date of the payment, it should be moved from closing contract to the new contract so the new contract's price will reflect the change in price following the payment.

Which contract will receive the payment depends on whether the date of that action (rollover or partially close) falls within the dates explained below for dividends and interests respectively:

Transfer dividends payments

If an open contract receives a dividend payment and is subsequently rolled over or partially closed so that the day of either action lands between ex-dividend date and record date (both days included), the payment should be transferred from that contract to the new contract.

Transfer interest payments

If an open contract receives a interest payment and is subsequently rolled over or partially closed so that the day of either action lands between ex-dividend date and payment date (excluding payment date), the payment should be transferred from that contract to the new contract.